本文來自《終極股息投資攻略》第4章,在原文基礎上有些調整,以便適合朗讀學習。

What Are Dividends, Anyway?

Glad you asked! Strictly speaking, a dividend is a transfer of assets from a corporation to its shareholders. A share of stock represents a bit of partial ownership in a business. A successful business typically has a good deal of assets, and management employs these assets to turn profits.Yet a corporation is an entity separate from its shareholders. You might look at a corporation as a lockbox containing all the assets and earnings of the business. As a shareholder, you own part of that lockbox, but you don't have direct access to its contents. The key to the lock is held by the corporation's management. Only when they decide to unlock the box and hand part or all of the cash inside to shareholders do those shareholders get to benefit directly from what is held inside.Not all corporations, even those with enormous profits and sizable cash reserves, are willing to unlock the box for shareholders' benefit, preferring instead to keep control of the cash for themselves. But many corporations do. Some pay out only a little, while others, the kinds of stocks we're interested in, pay out a lot.Furthermore, corporations that have paid dividends in the past have a very strong tendency to continue dishing out cash in the future. The box is opened and cash disbursed on a predictable basis, and over time, these payouts tend to grow larger and larger. From the investor's perspective, the value of a share of the box isn't about the box itself, but rather the growing stream of cash it will provide in the years and decades to come.

To consider just one example out of hundreds, let's look at the shareholder experience at Associated Banc-Corp over the past 20 years. At the end of 1986, shares of Associated sold for $4.08 apiece. Back then, Associated's dividend rate was running at just 10.6 cents a share. Dividing the 10.6 cents in annual dividends by the stock price of $4.08, we can say the stock provided a dividend yield of just 2.6 percent. The investor looking for income probably could have walked into one of Associated's bank branches and received a much higher rate of interest.Dividend yields may look like interest rates, although neither the dividend nor the stock that is paying it has a fixed, guaranteed value. But unlike the interest paid on a bond or a CD, Associated's dividend payments rose every single year thereafter. (See Figure 1.1.) Despite the initial yield of just 2.6 percent, just look how those dividends accumulated!By 1999, Associated had paid out cash dividends equal to the purchase price of the stock 13 years earlier. Seven years later, by the end of 2006, those cumulative dividends were 2.5 times the 1986 stock price. In 2006 alone, payments totaling $1.14 a share were equal to 28 percent of the 1986 purchase price. And even this was not the end: Associated raised its dividend yet again in early 2007. If history is any indication, many more decades of steadily rising payments lie ahead.But before you focus too closely on this ascending pile of accumulated dividends, step back to visualize the peace of mind this kind of performance inspires. Between 1986 and 2006, a period containing some of the great bull runs of all time, I count three major bear markets, a number of smaller corrections, and four major stretches of rising stock prices. Yet for the truly patient holder of the stock through this whole period, these fluctuations mattered not one bit. I can't go so far as to say that a dividend strategy is maintenance-free, but it's hard to imagine a better way to have your money working for you, rather than the other way around!

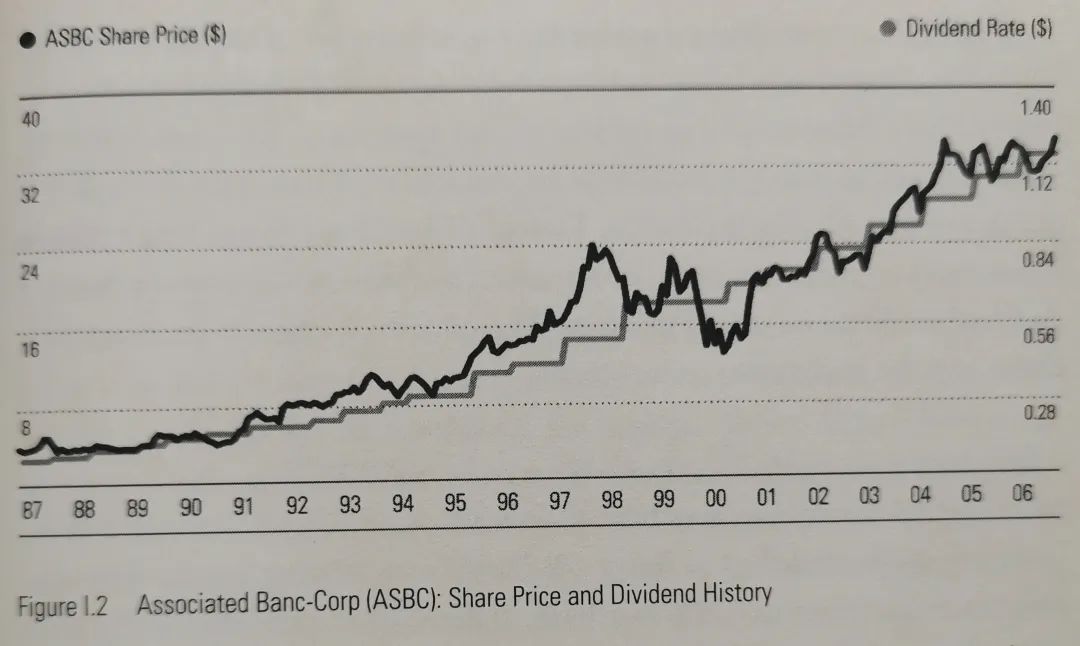

And not only did Associated's rising dividend provide more and more income as the years rolled by, but each dividend increase made the stock more desirable to own. Those dividends drove the market price of the stock higher in tandem, as shown in Figure 1.2. You may look at this chart and conclude that Associated's stock price alone might seem to have been a pretty nice investment; who needs dividends? But let's now invoke the concept of total return: capital gains and dividends working together to provide profits and build wealth. Associated's stock price rose an average of 11.3 percent annually over this 20-year stretch. Without dividends, that would have turned a $10,000 investment into roughly $85,000. But with dividends that same $10,000 investment compounds into a stake worth $161,000, nearly twice as much as from capital gains alone. The total return on the stock over these two decades was not just the 11.3 percent average annual capital gain, and not just the 3.2 percent average yield, but an average total return of 14.9 percent annually.I chose Associated not because it is a spectacular example of success, though in its own way it certainly has been. Instead, Associated is noteworthy precisely because it is so ordinary. This bank may not be well known across the country, but it certainly is to hundreds of thousands of depositors and loan customers in Wisconsin. Dozens of seemingly humdrum banks in other corners of the country have generated similar performances, as have hundreds of firms in other industries. The unifying factors are growing dividends and the patience to collect them. You may look at this chart and conclude that Associated's stock price alone might seem to have been a pretty nice investment; who needs dividends? But let's now invoke the concept of total return: capital gains and dividends working together to provide profits and build wealth. Associated's stock price rose an average of 11.3 percent annually over this 20-year stretch. Without dividends, that would have turned a $10,000 investment into roughly $85,000. But with dividends that same $10,000 investment compounds into a stake worth $161,000, nearly twice as much as from capital gains alone. The total return on the stock over these two decades was not just the 11.3 percent average annual capital gain, and not just the 3.2 percent average yield, but an average total return of 14.9 percent annually.I chose Associated not because it is a spectacular example of success, though in its own way it certainly has been. Instead, Associated is noteworthy precisely because it is so ordinary. This bank may not be well known across the country, but it certainly is to hundreds of thousands of depositors and loan customers in Wisconsin. Dozens of seemingly humdrum banks in other corners of the country have generated similar performances, as have hundreds of firms in other industries. The unifying factors are growing dividends and the patience to collect them.

|