Dividend Yield and Dividend Growth

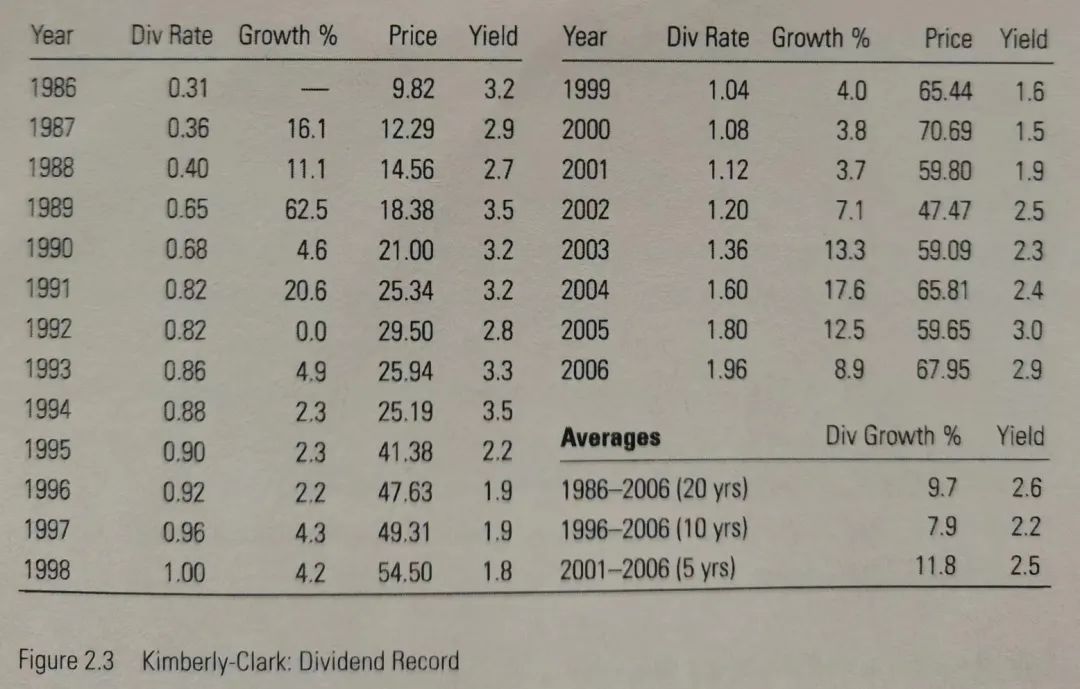

Let's put some meat on this math lesson with some examples, starting with Kimberly-Clark (KMB). If the name doesn't ring a bell, a trip down the right grocery store aisles will; think Kleenex, Huggies diapers, and Scott paper towels. Apparently we Americans are going through more of these products as time goes on, because their maker has been able to raise its dividend in each of the past 13 years. Looking at the past decade, we observe a pleasant upward trend. (See Figure 2.3.)

Even before probing Kimberly-Clark's fundamentals, we can see that the company's growth fluctuates from year to year. Between 1996 and 2001, dividend growth averaged only 4 percent annually. The succeeding five years show steeper annual progress, with average growth near 12 percent. It's too early to tell whether the overall growth rate of 7.9 percent is a good estimate of what to expect in the future, but with some variations already evident in the past, it's probably not a bad proxy.

What else do we know? In early 2007, Kimberly-Clark raised its dividend yet again, this time by 8.2 percent. The fact that the 2007 increase is almost equal to the growth rate of the past 10 years lends additional support to the notion that dividends should go on rising at about 8 percent annually. The past is no guarantee of future performance, of course--which is why Chapter 7 is devoted to forecasting future dividend growth potential. For now, though, I'll simply assume 8 percent is a sustainable rate of growth for Kimberly-Clark.

With quarterly dividends now running at an annualized $2.12, and the stock changing hands at roughly $71 in mid-2007, Kimberly-Clark offered a current dividend yield of 3 percent. Adding to that yield the dividend growth of 8 percent suggests the shares are priced to offer a total return of 11 percent in the years to come.

Is an 11 percent annual return good enough? Consumer product firms such as Kimberly-Clark tend not to be terribly risky, but all else being equal, I would demand a higher prospective return from a stock yielding 3 percent than I would from a similar business providing current income of 5 or 7 percent. A return of 11 percent looks good but not great--and not one that leaves much margin for disappointment. (Look for much more on this topic in Chapter 8.)

Kimberly-Clark provides a good example because both its yield and growth point to a realistic-looking dividend total return prospect. But recall my mention of low-yielding Graco shares earlier: With a dividend rate of $0.66 a share on a $40 stock, its yield is just 1.7 percent. The record of dividend growth is a much different story: Graco has raised its dividend in 9 of the past 10 years for a compound growth rate of 18 percent. Were Graco to maintain this rate of growth into the indefinite future, our total return formula points to a total return of 19.7 percent annually. Now there's some real dividend potential! (See Figure 2.4.)

The trouble is, 19.7 percent is not a realistic annual return to expect from any stock in perpetuity, nor is a growth rate of 18 percent sustainable for any business indefinitely. Look at it this way: For Graco's dividend to grow that fast over the next 50 years, the firm's total annual outlay for dividends would have to rise from $43 million in 2007 to $728 billion 50 years later. No matter how outstanding its prospects (and they are in fact very good), Graco is not capable of expanding that quickly into the indefinite future. In Graco's case, a 10 percent growth rate seems more likely than the past decade's 18 percent, but with a 1.7 percent yield, we could still expect a total return of around 11.7 percent going forward.